PROGRAM RELATED INVESTMENTS

HOW FOUNDATIONS CAN MULTIPLY THEIR IMPACTProgram Related Investments

HOW FOUNDATIONS CAN MULTIPLY THEIR IMPACTProgram Related Investments (PRI) are an under-utilized, but long-established form of foundation capital that can have a remarkable impact on solving today’s challenging problems for society. For foundations with a mission in healthcare, FullSky Partners can help develop PRIs with companies that have a dual mission of profit and purpose and a goal of treating medical challenges like cancer. Because PRIs are at the cross section of the private marketplace and the greater good, one can view them as “capital for social change.”

What is a PRI?

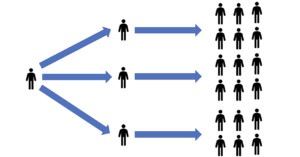

PRIs look like grants but act more like investments, for the foundation can receive its money back and then re-deploy it. When PRIs are made, they are counted in a foundation’s annual 5% required distribution. But because the rules allow for the return of capital, plus interest or capital gain, foundations can re-deploy the capital, and in this way, PRIs step up or magnify the charitable impact.

Who Can do PRIs?

Big foundations have been the leaders in this area and relatively few small or mid-sized foundations have used PRIs. However, FullSky Partners now develops PRIs for companies with a dual mission. This will allow foundations of all sizes with a mission in healthcare to easily benefit from PRIs and leverage their resources.

The first PRI was a loan made in 1968 by the Ford Foundation to Progress Plaza, a Philadelphia shopping center, to encourage minority business development.

A Proven Way to Increase the Impact of Foundations

Large foundations have become adept at setting up and implementing PRIs. Ford Foundation was a pioneer in PRIs when it launched the first such PRI for $10 million in 1968, with approval from the IRS. It has committed $600 million; Bill & Melinda Gates Foundation has committed $1.5 billion; MacArthur Foundation has made hundreds of millions in PRIs since it started doing them in 1986, while the David and Lucile Packard Foundation has made more than $750 million in PRIs. The Kresge Foundation said it would put 10% of its endowment toward such impact investments. PRIs span the gamut, with some in the area of economic development; others in affordable housing; still others in job creation or agriculture. Rockefeller Foundation commissioned an evaluation of its PRI portfolio and obtained a valuable insight: the most successful PRIs integrate an overarching investment strategy aligned with the foundation’s program strategy.

Bill & Melinda Gates Foundation made a PRI of $2 million in Inigral Inc , an education technology company, in 2011. Inigral developed the Schools App, an education-focused social media product on Facebook that is designed to help college students stay in school. It was the first PRI by Gates Foundation in a for-profit entity, and it invested alongside other investors in the company’s Series B equity financing.

Can I do PRIs?

The large foundations have been way out in front, for 98% of the nation’s 87,000 small foundations and donor-advised funds don’t use them. That’s because big foundations have the infrastructure and networks to pull together experts from a range of areas to structure and close such programs and opportunities. But most foundations can do PRIs as well. FullSky has developed the network and infrastructure to allow small and medium-size foundations and donor-advised funds to participate through coordinated group packages in PRIs.

In an example of helping a startup navigate through the Valley of Death, when companies are laying out funds for development and the pre-commercial phase before earning revenues, the David and Lucile Packard Foundation made a loan of $4.5 million as seed capital to Afaxys, Inc. The funds were to provide $7.2 million women in the United States access to oral contraceptives and other essential family planning products and to use group purchasing and the release of generic private label products. Afaxys received FDA approval to offer a generic contraceptive through public health clinics nationwide. Through the product launch of Chateal, its own private label oral contraceptive, Afaxys took a significant step toward its mission of ensuring affordable and reliable access to reproductive health product choices for women throughout the U.S.

Why PRIs?

Why would a foundation be interested in a PRI? Two reasons:

1) They are counted in the annual 5% required distribution.

2) Their return of capital can produce a significant multiplier effect to create a major step-up in impact.

In most cases, distributions by foundations are made as grants throughout the year to tax- exempt charities. The IRS Code also allows these distributions to be made as PRIs to for-profit enterprises, as long as they meet certain requirements. Unlike Mission related investments, PRIs are counted toward the 5% required annual distribution for foundations.

Moreover, once a PRI is made, that asset is no longer included in the base of assets used to calculate the 5% distribution amount. Assuming there is a return of the PRI, then those funds roll back into the foundation’s assets and can be used to make more PRIs or other grants. That’s where the multiplier effect comes in.

While a grant is a one-time event, a successful PRI can be re-deployed numerous times, or for as long as there is a return of the PRI. For example, if a foundation makes a PRI to a dual-mission company developing a cancer treatment, and that company is successful, it will return the PRI, with interest, and the foundation can take those funds and redeploy them to another opportunity.

FullSky also structures creative ways for foundations to re-deploy returned PRI funds: the interest or return on the PRI or even the returned capital can be used to fund cancer treatment for underprivileged children or individuals in the community who otherwise might not receive such care.

What are Some Areas for Investment?

The investment criteria for PRIs would have factors somewhat similar to for-profit investment opportunities, though they could be in areas with little or low returns. For example, affordable housing, climate change mitigation or minority enterprises, particularly in economically disadvantaged urban or rural areas of the country, are sectors in strong need of capital. They may offer little or no return, but the prospect of payback. For example, in affordable housing, one company has modernized the model of Single-Room Occupancy to allow police officers, school teachers and bus drivers to live in affordable rooms with wi-fi and shared amenities. With economically less developed locations, another opportunity is to develop light industrial, supply-chain companies around an infrastructure to allow minority-owned enterprises to tap into a larger business ecosystem.

MacArthur Foundation has also used PRIs to preserve affordable rental housing in the U.S. by supporting the work of 21 large nonprofit housing developers and 18 specialized financial intermediaries. The mission of these investments was to finance the improvement of 300,000 units of affordable rental housing over 10 years. In addition to supporting this largescale demonstration, the Foundation has made grants to support policy groups, public-private partnerships and research, all with the goal of fostering policies that facilitate and sustain timely, cost-effective preservation of affordable rental housing.

The Ford Foundation has committed $600 million to PRIs. One project invested in helping establish a women’s poultry cooperative in India. Another helped provide capital to expand credit unions serving low-income communities in California. Ford aims to use PRIs alongside its grants to advance social change and help people build better lives.

FullSky Partners focuses on healthcare, particularly in cancer, where we have found a rapid flow of innovative companies, with tremendous opportunities to save lives while earning returns. Sixty percent of all new drugs and devices approved by the FDA were developed by small companies, rather than large pharmaceutical corporations. But many early-stage ventures may never make it through “the valley of death,” that long journey where expenses are high from R&D but no revenues are yet coming in from hospitals and their patients. For instance, one company is using ultrasound therapy to treat brain cancer non-invasively and with little side effects. Another has developed a platform technology where low-cost blood tests screen for early detection of cancer, starting with colorectal, when survival rates are greater than 90 percent.

Requirements

There are numerous reasons small foundations don’t use PRIs. The IRS code regulates PRIs, so foundations must remain in strict compliance to qualify, and there are legal requirements that most foundations may not be equipped to undertake.

For example, there are several tests that a PRI must meet. The most important is that the PRI must be used for a charitable purpose that matches the mission of the foundation. That is, the investment must align with the foundation’s mission and “significantly further the accomplishment of the foundation’s exempt activities.” That purpose is critical in that the foundation must want to make the investment mainly because it helps further the foundation’s mission. This is called the “but for” test.

Another requirement is that the return or appreciation cannot be a major goal of the PRI. For this reason, PRIs often offer below-market returns compared to what for-profit investors receive. In fact, it is entirely possible for a foundation to invest through a PRI into a medical company alongside a commercial investor, but the structures and terms are entirely different for the foundation and the other investors.

There are also other tests and various reporting requirements under the IRS code. Moreover, another challenge for small foundations is that they often aren’t exposed to PRI opportunities.

Role of FullSky Partners

SonALAsense is an example of a PRI package that FullSky Partners arranges for foundations. It has developed a variety of PRI opportunities in the healthcare field, including companies that treat or screen for various types of cancer. It works with a number of experts with legal and accounting experience in PRIs. Along with its ability to pool together the interests of foundations around a particular opportunity, FullSky can therefore make undertaking a PRI much more efficient and affordable for smaller foundations. FullSky initially screens for opportunities, helps validate mission alignment, and pulls together leading experts to create qualification documentation, negotiate term sheets and agreements, structure PRI transactions and terms, carry them to completion and provide protocols for implementation, compliance and monitoring. This way, these transactions are more like turnkey operations for foundations.

As a result, FullSky helps lower the barriers to using PRIs. It allows foundations to have more impact and helps them leverage private capital for social good. In conclusion, FullSky is engaged by high quality companies who have a dual mission of profit and purpose. These companies have strong management teams, with compelling technologies that allow them to be matched with foundations and donor-advised funds through PRIs to amplify positive impact for society. We would be delighted to work with you.

For inquiries, please contact FullSky Partners:

Sheryl WuDunn – Sheryl@FullSkyPartners.com

Brett Oberman – Brett@FullSkyPartners.com

Norm Friedland – Norm@FullSkyPartners.com